Purveyors of Global Growth Capital & Exit Strategies

for Entrepreneurs & Middle Market Companies…

BOUTIQUE FIRM LEVERAGING BULDGE BRACKET EXPERTISE & CONNECTIONS

BOUTIQUE FIRM LEVERAGING BULDGE BRACKET EXPERTISE & CONNECTIONS NAVIGATING THE GLOBAL M&A LANDSCAPE ACROSS A WIDE RANGE OF INDUSTRIES

NAVIGATING THE GLOBAL M&A LANDSCAPE ACROSS A WIDE RANGE OF INDUSTRIES PROVEN PROCESS UTILIZING A CUSTOMIZED APPROACH TO M&A AND RAISING CAPITAL

PROVEN PROCESS UTILIZING A CUSTOMIZED APPROACH TO M&A AND RAISING CAPITAL

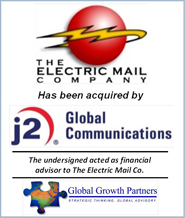

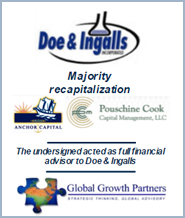

SELLING A COMPANY

Sales of private companies, divestitures,

majority and minority recapitalizations, spin-offs, split-offs, going private transactions, etc.

BUYING A COMPANY

Buy-side M&A advisory on strategic acquisitions, management buyouts, mergers, leveraged buyouts, acquisition searches & solicitation, etc..

RAISING CAPITAL

Debt and/or equity capital for acquisitions, recapitalizations, growth investments, shareholder liquidity events, refinancings, etc.

STRATEGIC ADVISORY

Analyses and advice on growth strategy, specific projects, capital structure, the need for liquidity,

diversification of wealth, and industry risk factors.

Typical Client Profile

- Revenues of $10.0 to $500 Million

- EBITDA of $2.0 to $30 Million

- Total Enterprise Value greater than $10.0 Million

- Experienced Management Team with a Proven Track Record

- Operating History of at least 3 or more years

- Growing or Stable industry dynamics

- Special Situations

Typical Transaction Characteristics

- Business owners looking to sell or acquire a company

- Company founder / owners seeking retirement / management transition

- Companies / management teams seeking equity and/or debt capital to acquire a business

- Multiple shareholders, with one or more seeking personal liquidity or an exit strategy

- Industry in transition with rapid innovation or consolidation

- Rapidly growing companies with non-traditional capital needs seeking debt and/or equity to support growth momentum

- Restructuring companies seeking turnaround capital

GGP works with a broad range of clients on a vast range of M&A